You are making your cash do what you want it to do, rather than spending without a strategy. The objective of budgeting is to constantly spend less than you earn. When you produce a budget plan, you appoint every dollar you make to a spending category. You can utilize a budget plan to: Lower your spendingUnderstand where your cash is goingIdentify bad financial habitsPay off debtAvoid producing brand-new debtPrioritize spending on things that are necessary to youSave for the future Budgeting is not a one-time action.

You might need to adjust your spending plan from month to month to account for large expenses or your own costs practices. When you know how much earnings you have, you can decide where to put it. When you are purposeful about where you spend it, you are in control of your cash.

When you owe money, you pay more than the cost of the initial purchase. You also have to make interest payments that can significantly cut into your earnings. Financial obligation suggests your cash isn't working for you, it's going towards paying that interest. It creates a financial concern and limits the options that you can make.

You can put it towards other financial objectives, such as saving for education, developing a retirement fund, taking a trip, or improving your living circumstance. You can start a company. You can begin investing it, allowing you to grow your wealth and create more financial stability and independence. If you have a lot of financial obligation and are feeling overwhelmed, you can use the snowball technique to control the debt repayment process.

Not known Details About How Much Money Does A Guy In Finance Make

Put whatever additional money you have towards paying off the smallest debt. Once it's paid off, move onto the next smallest. As you pay off your smaller sized financial obligations, you'll have more cash offered to pay off your bigger financial obligations. This momentum assists you focus your efforts and leave financial obligation faster.

An unexpected automobile repair, a medical procedure, a task loss, or any other monetary emergency can quickly send you spiraling into brand-new or more financial obligation, eliminating any development you have actually made towards taking control of your money. Developing an emergency fund is another way to make your cash work for you since it indicates you have actually prepared for surprises.

Building an emergency situation fund can take time. Ideally, you should conserve the equivalent of 3 to six months' worth of income. However every bit you can reserve will help. If you are still paying off financial obligation or do not have much wiggle space in your spending plan, reserved whatever you can in a "surprise expenditures" category in your spending plan.

Put your emergency situation savings in a high-yield savings account, which will make more interest than a regular saving or inspecting account. This means that the cash you save will generate income while it's being in your bank account. If your bank doesn't offer high-yield accounts or you reside in a rural location without a bank, try to find online banking options to open an account.

The 9-Second Trick For How Does Wells Fargo Capital Finance Make Money?

Once you have freed up all that money from paying off your financial obligation, you can put your money to overcome savings and investments. What you save for will depend upon your age, lifestyle, and objectives. In addition to an emergency situation fund, you will also require retirement accounts. You should likewise consider whether you need: Education savings, for yourself or your childrenTravel savingsA down payment fund for a houseSavings to start a businessA vehicle fund, for repairs or a brand-new vehicleExtracurricular fund for dependentsLong-term care cost savings, on your own or dependents By producing designated cost savings funds, you can track your progress towards particular objectives.

Keep in mind, when you pay interest, you are losing cash. However when you make interest, your cash is making more money all by itself. If you won't need your savings for numerous years or years, one of the finest ways to make your cash work for you is to invest. When you put your cash into financial investments, it grows all by itself through interest or the increased value of the thing you purchased.

Investing is a long-lasting strategy for constructing wealth. The most effective financiers invest early, then enable their cash to grow for years or years before utilizing it as income. Constantly buying and selling financial investments is likely to make less cash than a buy-and-hold method in the long run. As you begin investing, it is essential to diversify your portfolio.

If that single investment stops working, all your cash might be gone. Instead, spread that run the risk of out by purchasing a mix of: Exchange-traded funds (ETFs)Government bondsMutual fundsBusiness (your own or another person's) Many shared funds or brokerage firms have a minimum quantity for novice financiers. You might require to save up that minimum amount prior to you begin investing.

The Which Careers Make The Most Money In Finance Diaries

No matter how you are saving or investing, have a specific set of goals. Know what you are working towards, like paying for your child's education, acquiring a home, or early retirement. This will help focus your spending and provide you inspiration, as well as helping you choose what types of investment are the best for you.

The info is existing without factor to consider of the investment objectives, risk tolerance, or financial scenarios of any particular financier Take a look at the site here and may not appropriate for all financiers. Previous performance is not indicative of future outcomes. Investing involves danger, including the possible loss of principal.

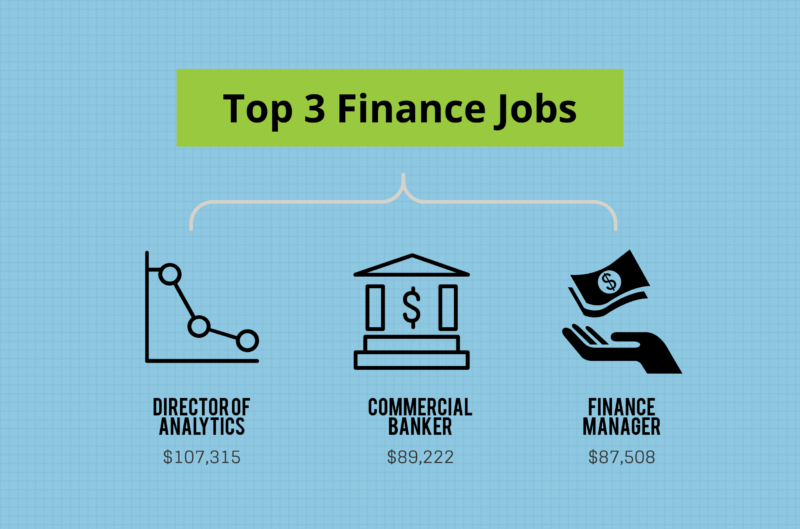

Financing jobs can be incredibly profitable professions for people who have strong mathematical and analytics skills. The market of finance is broad and includes everything from banking and investments to monetary innovation, or Fintech, as it's commonly understood. If you've been believing about starting a career in finance but are uncertain of which way to go, you're in the best place.

Financing offers an inspiring variety of chances to specialize for people who are interested in the field. These high-paying opportunities exist in one of 6 categories, as explained listed below: These are chief executives and other jobs at enterprise companies and corporations both public and personal. These kinds of jobs are frequently in an office and hold more traditional hours.

Personal Finance Reddit How To Make Money From Home Things To Know Before You Get This

Advisors require to integrate monetary knowledge with sales acumen. Financial innovation accounts for monetary programmers and even some of what CFOs do. In today's normal enterprise service, financing departments support innovation infrastructure permitting Fintech to overlap a variety of other professions in financing. Financial professionals who work in investments are responsible for putting capital into portfolios that assist people and business development wealth.

People who operate in providing help consumers select loans, or perform a few of the operational tasks of assisting customers secure loans. Quickly apply to tasks with a Certainly ResumeHere are the highest paying financing tasks: Financial investment lenders handle the portfolios of organizations and government firms that purchase a variety of various organizations. Take a look at my Ultimate Guide to Personal Financing for ideas you can implement TODAY. A 401k enables you to invest money for retirement AND get free money from your employer while doing so. Here's how it works: Each month, a portion of your pre-tax pay is invested instantly into the 401k.

You aren't taxed on your incomes till you withdraw it at retirement age (59 years old). This indicates that you'll make more with intensifying over your life time. Picture you make $100,000/ year and your business offers you a 3% match on your 401k. If you invest $3,000 (3% of $100,000), your company will match you that much in your 401k.

In 2019 the contribution limitation for a 401k is $19,000. Maxing it out is a remarkable goal to have. Make certain to benefit from your employer's 401k strategy by putting at least adequate money to collect the company match into it. This guarantees you're taking complete benefit of what is basically complimentary cash from your employer.

Facts About How Much Money Do Finance Researchers Make Revealed

If you're worried about your individual financial resources, you can enhance them without even leaving your couch. Have a look at my Ultimate Guide to Personal Finance for pointers you can implement TODAY. how much money do i need to make to finance a car. This is another tax-advantaged retirement account that enables amazing growth and savings. Unlike your 401k, though, this account leverages after-tax income.

AMAZING. Like your 401k, you're going to desire to max it out as much as possible. The amount you are allowed to contribute increases occasionally. As of 2019, you can contribute approximately $6,000/ year. I recommend putting money into an index fund such as the S&P 500 as well as a worldwide index fund as well.

: If you don't understand where to find the cash to purchase these accounts, learn how you can save a bunch of cash with. If you're fretted about your individual financial resources, you can improve them without even leaving your couch. Have a look at my Ultimate Guide to Personal Finance for ideas you can execute TODAY.

The 2nd finest time is today. I understand, I understand. I seem like a tacky motivational poster but the saying is true. If you want to purchase a home or a good car one day, you do not wish to think about where you're going to get the cash the day you plan to buy it.

How To Make A Lot Of Money With A Finance Degree Can Be Fun For Anyone

That's why I'm a HUGE supporter of. There are still individuals out there who have heard me harp on this for literal YEARS and still have not automated their finances. And why not? For a few hours of work, you can save yourself countless dollars down the roadway. One reason many are averse to saving money is due to the discomfort of putting our hard-earned money into our cost savings accounts each month.

It's a set-it-and-forget-it method to your financial resources, allowing you to send all of your cash precisely where you require it to go as soon as you receive your income. After all, if you needed to track your costs and move cash into savings every month, it would become one of those "I'll get to that later" things and you 'd NEVER get to it.

That's why. You can begin to control your finances by having your system passively do the best thing for you. Instead of thinking about conserving every day set it and forget it. To do this, you need simply one hour today to set everything up so your paycheck is divided into 4 significant containers as quickly as it shows up in your bank account.

Like your 401k, you're going to desire to max it out as much as possible. The amount you are allowed to contribute increases occasionally. Presently, you can contribute up to $6,000 each year.: Here, that you've developed for long-term objectives like your wedding, vacation, or down payment on your house.

The How Much Money Does Finance Make Statements

: Make automatic payments for recurring services like Netflix, Birchbox, and gym subscriptions using your credit card. You're going to have a lot of guilt-free pocket money in here for things like the periodic night out or enjoyable purchases you desire to make. Be sure to log into your credit card's website and set up automatic payments with your bank account so your charge card expense is paid off monthly.

: These are for bills that can't be settled with a credit card, such as lease, electric, water, and gas. When https://blogfreely.net/harinn60qi/as-a-business-owner-you-have-numerous-choices-and-the-roller-coaster-of that cash is in your savings account, do not touch it unless you're prepared to pay for your long-lasting goal (or if there's a HUGE emergency). For more details on how to automate your finances, take a look at my 12-minute video where I go through the precise process with you.

Inspect out my Ultimate Guide to Personal Financing for suggestions you can execute TODAY. As soon as you automate your finances, you can enhance your cost savings by leveraging a sub-savings account. This is a savings account that you can create within your regular cost savings account to save for specific purchases or events.

Once the transfers remain in place, you're going to get a lot closer to your cost savings goals. AND you can do it without needing to keep in mind to set money aside. Take a look at all the various sub-savings accounts I had in my old cost savings account: ING Direct is now Capital One 360.

The Only Guide to How Do People Make Money In Finance

I used the cash I saved to buy an engagement ring. So established a sub-savings account and begin immediately putting cash into it every month. If you require aid, take a look at my post to begin. This is an example of using a system to make certain you have actually the cash required for an expensive purchase.

You can even set aside money for more nebulous things. See my "foolish mistakes." Or perhaps you can have a "for when my pal insists on 'simply another beverage'" account. Now, each time I wish to spend money on a costly purchase, I UNDERSTAND I have the cash. Due to the fact that I have been keeping a little bit at a time immediately.

If you're stressed over your personal financial resources, you can improve them without even leaving your couch. Take a look at my Ultimate Guide to Personal Finance for suggestions you can implement TODAY. Target-date funds (or lifecycle funds) are a collection of properties that instantly rebalance and reallocate themselves as time goes on.

Target-date funds diversify based on your age. This means the funds will instantly change to be more conservative as you age. For example, if you wish to retire in thirty years, a good target-date fund would be the Lead Target Retirement 2050 Fund (VFIFX), since 2050 will be close to the year you'll retire.